FDI into Vietnam Surged Despite COVID-19 Surgence

|

HSBC recently released the South East Asean FDI report, in which Vietnam and Malaysia are considered to be the top countries for FDI, following are the main points:

• Despite the pandemic, FDI continues to pour into Southeast Asian markets, especially into the manufacturing sector

• Vietnam and Indonesia stand out, with the former transforming into a tech production base and the latter focusing on the EV supply chain

• Improvements in the regulatory framework for FDI in inpidual ASEAN economies in recent years should help attract substantial further inflows

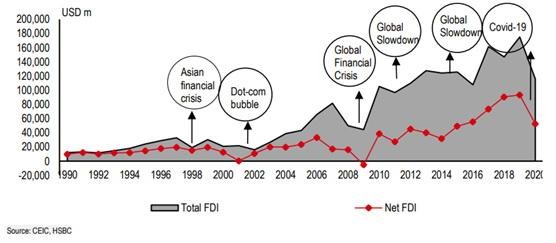

ASEAN has seen a FDI boom in recent years, thanks in large part to the region’s substantial economic potential. The Global Financial Crisis (GFC) in 2008-09 was a significant catalyst to the region’s FDI boom, as multinational companies searched for investment opportunities in fast growing and cost-competitive economies. Total FDI to ASEAN-6 (Singapore, Malaysia, Indonesia, Thailand, Vietnam and the Philippines) has average nearly USD127bn per year since 2010, approximately 3x more than the average over the previous decade (average in 2000-09: USD41bn). Similarly, net FDI (inbound minus outbound direct investment) averaged nearly USD54bn a year since 2010, almost 4x the average from the previous decade (Exhibit 1).

|

Exhibit 1: Total FDI and net FDI to ASEAN have risen significantly since the GFC

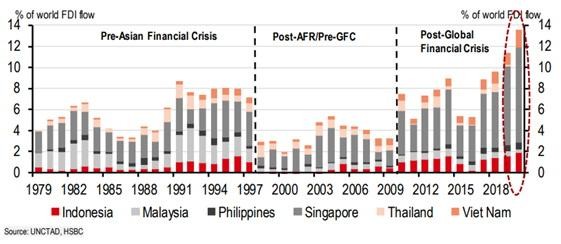

The share of ASEAN-6 inflows of world FDI also further exemplifies this trend. While the Asian Financial Crisis (AFC) had an initially deleterious effect on ASEAN’s investment climate, FDI poured back into the region more substantially after the GFC. In particular, FDI has been holding up extremely well since the start of the global pandemic. In fact, ASEAN-6 accounted for a record high of around 13% of world FDI inflows in 2020, largely thanks to booming flows into Singapore (Exhibit 2). HSBC believes this trend is likely to continue in the medium term, given ASEAN’s growth outlook remains robust.

|

Exhibit 2: ASEAN reached a record share of world FDI in 2020

It is key to note that not all ASEAN economies have benefitted equally from the recent FDI boom. Much of the flows since the GFC have predominantly gone to Singapore, while the Philippines and Indonesia still have received a relatively small share of inflows. FDI as a percentage of GDP in Singapore has increased to over 20% on average since 2010, and it has been an increasingly attractive investment destination for persified manufacturing sectors, especially in advanced manufacturing (though note that, as a regional financial centre, the size of Singapore’s inflows is not necessarily comparable to that of other economies).

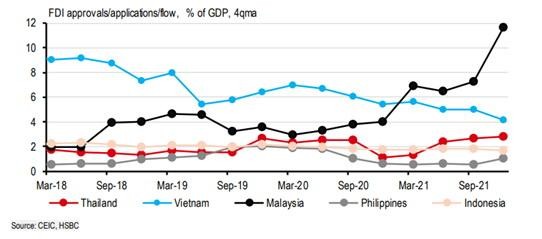

Looking at high frequency data, Malaysia and Vietnam also stand out, with the former’s 4Q22 FDI approvals jumping to as high as 12% of GDP and the latter successfully transforming into an emerging global production base (Exhibit 3). While the Philippines’ share and Indonesia’s share remain below the share of their regional peers, it is encouraging to see that they have also pushed for structural reforms to improve the investment climate.

Thinking of FDI-driven economic success stories, Vietnam naturally stands out: Vietnam has turned itself into a rising star in global supply chains, gaining substantial global market share in sectors, including textiles, footwear and consumer electronics. Since Vietnam’s Doi Moi reforms in 1986, industrial parks have been set up across the country, attracting investors with preferential tax incentives and an abundance of relatively cheap and productive labour. New FDI has been flowing into the country since the 2010s, with the lion’s share concentrated in the manufacturing sector, consistently accounting for 4-6% of GDP (Exhibit 3).

|

Exhibit 3: Malaysia and Vietnam are consistently the top FDI receivers relative to GDP

Much of the investment initially entered the low value-add textile and footwear space; however, Vietnam has climbed up the value chain over the years, growing into a key manufacturing hub for electronics products in the last two decades. Electronics exports reached a record high of USD100bn in 2021, accounting for over 30% of Vietnam’s total exports; just 20 years ago, the share was only 5%.

Much of the success in tech is thanks to Samsung’s multi-year FDI in Vietnam, which started in the late 2000s. With an investment of around USD18bn over the years, Samsung now has eight factories and one R&D centre in Vietnam, including two smartphone factories, producing half of the company’s smartphones and tablets.

The success of Samsung has led to other tech giants, such as Google and LG, shifting their supply chains to Vietnam. The trend intensified during the US-China trade tensions, which not only lifted Vietnam’s exports but also accelerated FDI inflows.

Even though the process was partially disrupted by COVID-19, FDI inflows have remained remarkably resilient, in particular related to Apple-connected production. For example, two Taiwanese Apple suppliers, Pegatron and Foxconn, and two mainland Chinese assemblers, Luxshare and Goertek, have all announced substantial investment plans to ramp up production capacity in Vietnam.

HSBC believes Vietnam’s competitive FDI regime and sound macro fundamentals should continue to attract quality FDI, which is key in helping the economy move up the value chain. Its tech ambition is far from just being a low-end manufacturing hub, however, which means more reforms, including upskilling the workforce and improving infrastructure quality, are need to grasp the opportunities.

The FDI policy environment in ASEAN has improved meaningfully over the last few years as more favourable policies have been introduced. In particular, Indonesia and Vietnam have seen the biggest improvements, including improving infrastructure, easing investment restrictions, and better fiscal management, just to name a few.

Các tin khác

Tough year expected for banks in 2023

Vietnam’s Hiking Cycle Under Way, HSBC Says

Amazon Global Selling Vietnam Reveals its 2022 Vietnam SMEs Empowerment

Asia Economies to Benefit from China’s Opening in Second Half 2023

One More HDBank Leader Registered to Buy HDB Shares

Sign of a Loan Agreement for Ninh Thuan Province Onshore Wind Power Project

ADB, BIM Wind Sign $107 Million Financing Package to Support Wind Energy in Viet Nam

International Agreement to Support Vietnam’s Ambitious Climate and Energy Goals

Vietnam to Receive $15.5 billion for Energy Transition

FPT Announced Business Results in the 11 Months of 2022

ADB Lowers Growth Forecast for Developing Asia amid Global Gloom

Amazon Announces its Biggest Holiday Shopping Weekend Ever

Unilever Vietnam to Consolidate the Position in Circular Economy

HSBC: The Vital Role of Voluntary Carbon Markets

Archetype Group Celebrated 20 Years of Growth

ADB, HAYAT KIMYA to Support for Women and Children’s Lives in Vietnam

HDBank is the Large-Cap Listed Company With the Best Annual Report 2022

Sobanhang Excellently Won the Champion of National Innovative Technopreneur Contest

General Director of HDBank Continues to Rregister to Buy 1 Million of HDB Shares